ROCKLAND RESOURCES ACQUIRES STRATEGIC COLE GOLD MINE PROPERTY, WEST RED LAKE, ONTARIO

Potential for High Grade “Red Lake” Type Gold Mineralization in a Prolific District

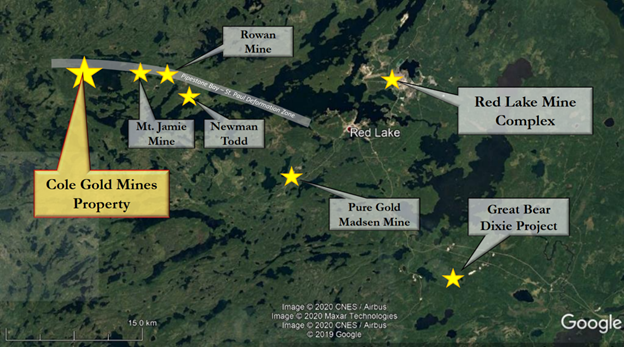

Vancouver, British Columbia, March 29, 2021: Rockland Resources Ltd. (the "Company" or "Rockland") (CSE: RKL) wishes to announce the signing of an agreement whereby the Company can acquire a 100% interest in the “Cole Gold Mine Property” (Property”), located in Ball Township, Red Lake Mining District. The current Cole Gold Mine Property consists of 28 mining claims (568 ha) located 30 kilometers west of the Cochenour, Campbell, Red Lake Mine Complex owned and operated by Evolution Mining. The property is being acquired from Wabassi Resources ULC. (“Wabassi”), whom have an option to acquire 100% interest from the underlying Property owners.

Company director Mike England states: “The Cole Gold Mine acquisition represents a rare, unusual opportunity to acquire an under explored, exciting. strategically located gold property in one of the most active, prolific producing mining districts in Canada. The Property has not been explored since 1973 when gold price averaged only $106.50/ounce for that year. The property has historic indications to host high-grade gold values in a classic “Red Lake type” quartz veins and silica-sulphide replacement zones.”

Highlights:

- History - The original Cole Property was staked by John Younglove Cole in early 1926, with shaft sinking in 1933 to a 60.9 meters (200-foot) depth, and the claims were patented. The Cole Gold Mines was incorporated in November 1933, and by 1937 the vertical shaft had reached a depth of 161.5 meters (530 feet) with over 2,133.6 meters (7,000 feet) of drifting and crosscutting on four levels. Cole Gold Mines also completed over 1,219.2 meters (4,000 feet) of underground diamond drilling to the end of 1937.

- Last Exploration Work - The only documented exploration work on the site was done by Kerr Addison Mines in 1973. The company completed both magnetometer and electromagnetic surveys as well as 2,108 metres (6,916 feet) of diamond drilling.

- Tenure Legacy – the Cole Gold Mine Property was retained by the Cole Family Estate until 2018, when the patented were forfeited and the property was released for digital staking by the Ontario Ministry of Energy, Northern Development and Mines (“MENDM”).

- Geology and Gold Mineralization – High grade gold values are associated with sphalerite chalcopyrite scheelite bearing quartz veins in shear and structural zones in the porphyry and felsic rocks, striking approximately east-west, and dipping steeply to the north. Historic diamond drilling by Kerr Addison Mines has returned values up to 2.2 oz/ton gold (68.3 grams gold per tonne (Au g/t) over 1.5 ft (0.46 meter) core width in sulphide mineralized quartz veins.

- Recent Sampling –From a total of 38 grab samples and 15 sawn channel samples taken by Wabassi in 2020, the four best samples returned values of 57.7 Au g/t, 16.7 Au g/t, 14.8 Au g/t, and 7.21 Au g/t. Six additional samples returned values of 0.5 Au g/t or higher. Six grab rock samples taken in 2020 by the author of a 43-101 geology report on the Property returned 6.34 Au g/t, 1.01 Au g/t, 0.62 Au g/t, 0.30 Au g/t, 0.13 Au g/t and one sample with low gold values (less than 0.01 Au g/t).

- Permit Status - The Property has an approved Exploration Permit PR-20-000368 that is valid until March 3, 2024 and allows for a diamond drill program to be initiated in the short term.

Terms of Acquisition

The Company can earn 100% interest (less NSR) in the Cole Gold Mine Property through cumulative option payments in cash of CDN $410,000 and common shares in the Company with a deemed value of CDN $650,000, with a minimum year one work commitment of CDN $300,000. Wabassi retains a 2.0% net smelter royalty (NSR) on production from the Property, 0.5% of which can be purchased for $750,000 at any time. The underlying Vendor of the Cole Gold Mine Property also retains a 1.0% NSR, and the Company will have an option to purchase 0.5% of the NSR for $750,000.

Company director Mike England further reports “With permits to drill in hand, the Company will be proceeding rapidly to complete a maiden drill program on the Cole Gold Mine Property, directed at the discovery of high-grade, gold mineralization in a classic “Red Lake” geologic model”, similar to Great Bear Resources Ltd on the Dixie Property located 35 kilometers to the southeast”.

The reader is cautioned that historic data and information presented above were completed prior to the implementation of National Instrument 43-101 and must be considered only as a historic reference. Neither the Company nor its Qualified Person have completed sufficient work to verify this historic drill hole, and they should not be relied upon.

Qualified Person

Garry Clark P.Geo., a Qualified Person under National Instrument 43-101, is the Qualified Person responsible for reviewing and approving the technical contents of this news release as they pertain to the Cole Gold Mine Property.

About Rockland Resources Ltd.

Rockland Resources is engaged in the business of mineral exploration and the acquisition of mineral property assets in Canada. Its objective is to locate and develop economic precious and base metal properties of merit and to conduct its exploration program on the Summit Old Timer Property. The Summit Old Timer Property consists of three (3) mineral claims covering an area of 1,915 hectares located approximately 17 km southeast of the City of Nelson, within the Nelson Mining Division, British Columbia.

For more information, please refer to the Company's prospectus dated February 3, 2021 available on SEDAR (www.sedar.com).

On Behalf of the Board of Directors

Mike England

CEO, President and Director

For further information, please contact:

Mike England

Office: 604-683-3995

Email: mike@engcom.ca

Forward-Looking Statements:

This news release includes certain forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, anticipated content, commencement, and cost of exploration programs in respect of the Company's projects and mineral properties, anticipated exploration program results from exploration activities, resources and/or reserves on the Company's projects and mineral properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "will", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration of the Company's properties, that the COVID-19 global pandemic will not affect the ability of the Company to conduct the exploration program on the Summit Old Timer Property, the availability of financing on suitable terms, and the Company's ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, statements as to the anticipated business plans and timing of future activities of the Company, including the Company's option to acquire the Summit Old Timer Property, the proposed expenditures for exploration work thereon, the ability of the Company to obtain sufficient financing to fund its business activities and plans, delays in obtaining governmental and regulatory approvals (including of the Canadian Securities Exchange), permits or financing, changes in laws, regulations and policies affecting mining operations, risks relating to epidemics or pandemics such as COVID–19, including the impact of COVID–19 on the Company's business, financial condition and results of operations, the Company's limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading "Risk Factors" in the Company's prospectus dated February 3, 2021 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release except as otherwise required by law.

Back To Archive